Table of contents

Risk management is the process of identifying, assessing, and mitigating the uncertainties that can affect an organization’s ability to achieve its objectives. In today’s dynamic and complex environment, risk management is more important than ever. Organizations face a variety of potential risks, such as cyberattacks, natural disasters, regulatory changes, market volatility, and reputational damage. These types of risks can have significant impacts on an organization’s performance, reputation, and sustainability.

To effectively manage risks, organizations need to adopt a proactive and systematic approach that covers the entire risk lifecycle.

In this blog post, we will explore some of the most effective risk management techniques that can help organizations navigate today’s challenges and opportunities.

1. Risk Identification: Bowtie Analysis

Risk identification is often one of the first risk management techniques implemented by organizations. It involves identifying the potential sources of harm or loss that can affect an organization’s objectives. These sources are called hazards. Some examples of hazards are fire, flood, theft, virus, or human error.

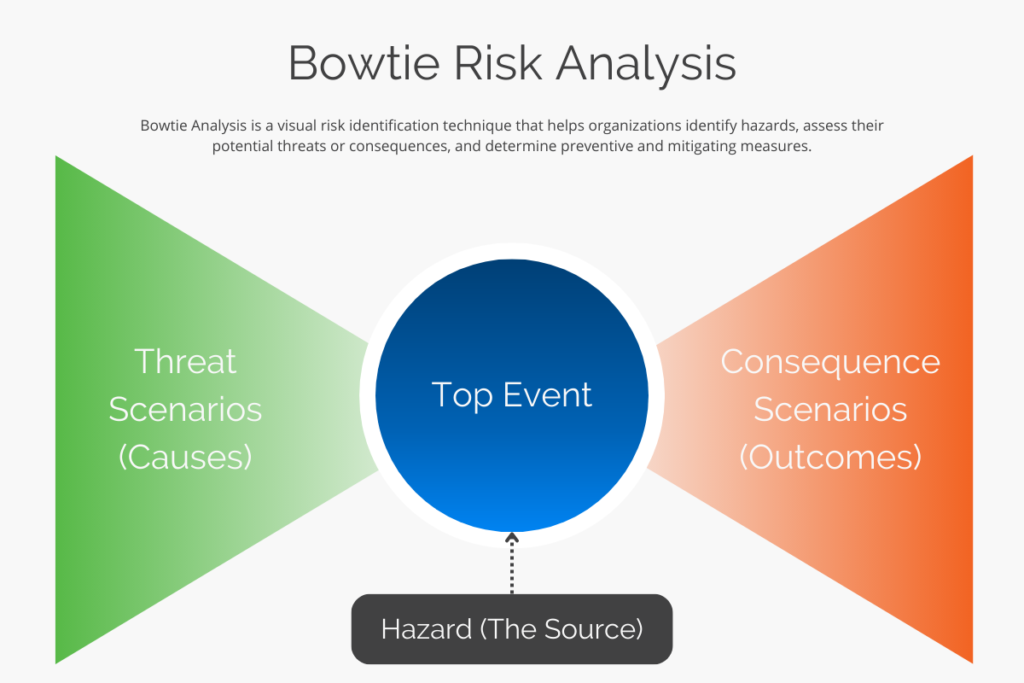

Bowtie Analysis is a visual risk identification technique that helps organizations identify hazards, assess their potential threats or consequences, and determine preventive and mitigating measures. A bowtie diagram consists of four elements: a hazard (the source of potential impact), a top event (the loss of control over the hazard), threat scenarios (the causes of the top event), and consequence scenarios (the outcomes of the top event).

The diagram resembles a bowtie, with the top event in the center and the threat scenarios on the left, and the consequence scenarios on the right. The diagram also shows the barriers (the controls or actions) that prevent or reduce the likelihood of threat scenarios or consequence scenarios.

Risk analysis like the Bowtie Analysis helps organizations visualize and understand the causal relationships between hazards, events, scenarios, and barriers. It also helps identify gaps or vulnerabilities in existing controls and prioritize areas for improvement.

2. Risk Assessment and Prioritization: Risk Heat Maps

Risk assessment involves analyzing and evaluating the identified risks based on their impact and likelihood. The impact is the degree of harm or loss that a risk can cause to an organization’s objectives. The likelihood is the probability or frequency of a risk occurring. Risk assessment helps organizations determine which risks are more important or critical than others.

Risk Heat Maps are graphical tools that help organizations visualize and prioritize risks based on their impact and likelihood. A risk heat map consists of a matrix with impact on one axis and likelihood on another. Each specific risk is plotted on the matrix according to its impact and likelihood scores. The matrix is divided into different zones (such as low, medium, high, or extreme) that indicate the level of risk.

Risk Heat Maps help organizations allocate resources and focus on critical risks that require immediate attention or action. They also help communicate risks to stakeholders in a clear and concise manner.

3. Risk Mitigation Strategies: Hierarchy of Controls

Risk mitigation is when organizations select and implement appropriate measures to reduce or eliminate the impact or likelihood of risks. These measures are called controls. Some examples of controls are alarms, locks, fire extinguishers, backup systems, or training.

Developed by The National Institute for Occupational Safety and Health (NIOSH), The Hierarchy of Controls is a framework for risk mitigation that ranks different types of controls according to their effectiveness in reducing or eliminating risks. The framework consists of five levels of controls:

- Elimination: The most effective control that removes the hazard or source of risk completely.

- Substitution: The second most effective control that replaces the hazard or source of risk with a less hazardous or risky one.

- Engineering Controls: The third most effective control that isolates or separates people from the hazard or source of risk through physical means.

- Administrative Controls: The fourth most effective control that changes the way people work or behave to reduce exposure to the hazard or source of risk through policies, procedures, training, or supervision.

- Personal Protective Equipment (PPE): The least effective control of the five listed that protects people from the hazard or source of risk through wearing appropriate clothing or equipment.

One of the widely-used risk management techniques, Hierarchy of Controls helps organizations select the most effective and feasible control measures for each risk. It also helps avoid relying solely on PPE as a primary means of protection.

4. Risk Transfer and Insurance: Contractual Risk Allocation

Risk management techniques such as risk transfer are another option for implementing into your risk reduction efforts. It is when shifting some or all of the responsibility or liability for a risk to another party takes place. This can be done through contractual agreements or insurance policies. Some examples of risk transfer are outsourcing, subcontracting, leasing, indemnification, or insurance.

Contractual Risk Allocation is a risk control technique for transferring risks to other parties through contractual agreements. It involves using clauses that specify who is responsible for bearing certain risks and liabilities arising from a contract. Some examples of contractual risk allocation clauses are:

- Indemnification Clauses: Clauses that require one party to compensate another party for any losses or damages incurred due to a breach of contract or negligence.

- Hold-Harmless Agreements: Clauses that require one party to waive any claims or lawsuits against another party for any losses or damages arising from a contract.

- Limitation of Liability Provisions: Clauses that limit the amount or type of liability that one party can impose on another party for any losses or damages arising from a contract.

Contractual Risk Allocation helps organizations manage risks by shifting them to other parties who are better able or willing to handle them. It also helps reduce potential disputes and litigation costs.

Insurance is another form of risk transfer. It involves paying a premium to an insurance company in exchange for coverage or compensation in case of a loss or damage caused by a risk. Some examples of insurance are property insurance, liability insurance, business interruption insurance, or cybersecurity insurance.

Insurance helps organizations protect themselves from financial losses and recover from adverse events. It also helps share risks with other parties who face similar risks.

5. Crisis Management and Response Planning: Business Impact Analysis (BIA)

Crisis management and response planning involve preparing for and responding to unexpected or disruptive events that can threaten an organization’s objectives, operations, reputation, or stakeholders. These events are called crises. Some examples of crises are fire, flood, earthquake, pandemic, cyberattack, or scandal.

Business Impact Analysis (BIA) is a technique for preparing for and responding to such crises. It involves identifying critical business functions (the activities essential for delivering products or services) and analyzing their dependencies (the resources or inputs required for performing them). It also involves estimating the impact (the loss or disruption) that would result from each function being unavailable for a certain period of time.

BIA helps organizations prioritize critical functions and develop effective response and recovery plans. It also helps identify alternative solutions or contingency plans for maintaining business continuity in case of a crisis.

6. Risk Monitoring and Early Warning Systems: Key Risk Indicators (KRIs)

Successful risk management techniques like risk monitoring use strategies such as early warning systems to assist with your risk-mitigating efforts. They involve tracking and measuring the performance and effectiveness of risk management activities and controls. Additionally, they relate to detecting and reporting any changes or deviations in risk levels or conditions. These changes or deviations are called risk events. Some examples of risk events are new risks, increased risks, decreased risks, realized risks, or missed opportunities.

Key Risk Indicators (KRIs) are metrics that help organizations monitor and track risks in real time. They are derived from data sources that reflect changes in risk levels or conditions. They are also linked to predefined thresholds or targets that trigger alerts or actions when exceeded or breached.

KRIs help organizations identify emerging risks and take proactive measures to mitigate them before they escalate into crises. They also help measure the effectiveness of existing controls and improve risk reporting and communication.

30+ Audit and inspection checklists free for download.

7. Risk Communication and Stakeholder Engagement: Risk Workshops

Risk communication and stakeholder engagement involve sharing and exchanging information and opinions about risks with relevant parties. These parties are called stakeholders. Some examples of stakeholders are employees, customers, suppliers, investors, regulators, media, or the community.

Risk Workshops are interactive sessions that involve key stakeholders in risk management processes. They facilitate open dialogue, brainstorming, and collective decision-making among participants. They also foster collaboration, trust, and accountability among stakeholders.

Risk Workshops help organizations identify stakeholder expectations, perspectives, concerns, and needs regarding risks. They also help align stakeholder objectives, roles, responsibilities, and actions in risk management.

8. Risk Culture and Awareness: Training and Education Programs

Finally, consider attributing resources in your risk management plan towards focusing on your risk culture and awareness. A crucial aspect of risk management is fostering a positive attitude and behavior toward it among all team members of an organization. Additionally, it’s important to improve the knowledge and skills of employees in regard to risk management.

Training and Education Programs are initiatives that aim to enhance the knowledge, skills, attitudes, and behaviors of employees regarding risk management. They include formal courses, workshops, seminars, webinars, e-learning modules, case studies, simulations, games, quizzes, newsletters, posters, videos, podcasts, etc.

Training and Education Programs help employees understand and actively contribute to risk avoidance initiatives. They also help build a risk-aware culture that values transparency, accountability, and learning from risks.

You might also be interested in: