Table of Contents

- Why Supply Chain Risk Is a Strategic Priority Today

- What Is Supply Chain Risk Management (SCRM)?

- 7 Categories of Supply Chain Risk Factors

- Scoring and Prioritizing Supplier Risk

- How High-Performing Teams Operationalize Risk Intelligence

- Why SCRM Programs Falter

- The Untapped Potential of Internal Audit Data

- Why Supply Chain Risk Management Is a Competitive Advantage

- How Certainty Software Supports Resilient, Risk-Ready Supply Chains

Why Supply Chain Risk Is a Strategic Priority Today

One missed delivery window or a supplier falling short on compliance can trigger cascading consequences across a supply chain. In an increasingly interconnected ecosystem, what once might have been a minor hiccup now reverberates globally, impacting everything from inventory turnover to brand perception.

The landscape has changed. Risks have grown more complex, more interconnected, and more frequent. Gartner reports that 89% of companies experienced a supplier risk event in the past five years that resulted in significant operational disruptions (source). These challenges span beyond procurement into compliance, sustainability, operational resilience, and enterprise risk.

For compliance leaders, proactive supply chain risk management shifts from minimizing loss to creating an opportunity to build an adaptable and accountable supply network. One that is ready to withstand volatility without compromising performance.

What Is Supply Chain Risk Management (SCRM)?

Supply Chain Risk Management involves identifying, evaluating, and mitigating vulnerabilities that affect the movement of goods, services, data, and compliance across the supply network. While the foundational principles remain—assess, manage, and improve, modern programs are being designed to act as real-time intelligence engines.

Risk management today is tightly woven into daily operations. It’s supported by digital tools that can surface early signals like production slowdowns, regulatory shifts, and geopolitical tensions, before they evolve into crises. Mature programs move beyond simply documenting their problems. Rather, they translate insights into timely decisions across procurement, compliance, ESG, and quality.

The goal is business continuity. Uninterrupted operations backed by trustworthy data, transparent suppliers, and systems that adapt at the speed of risk.

30+ Audit and inspection checklists free for download.

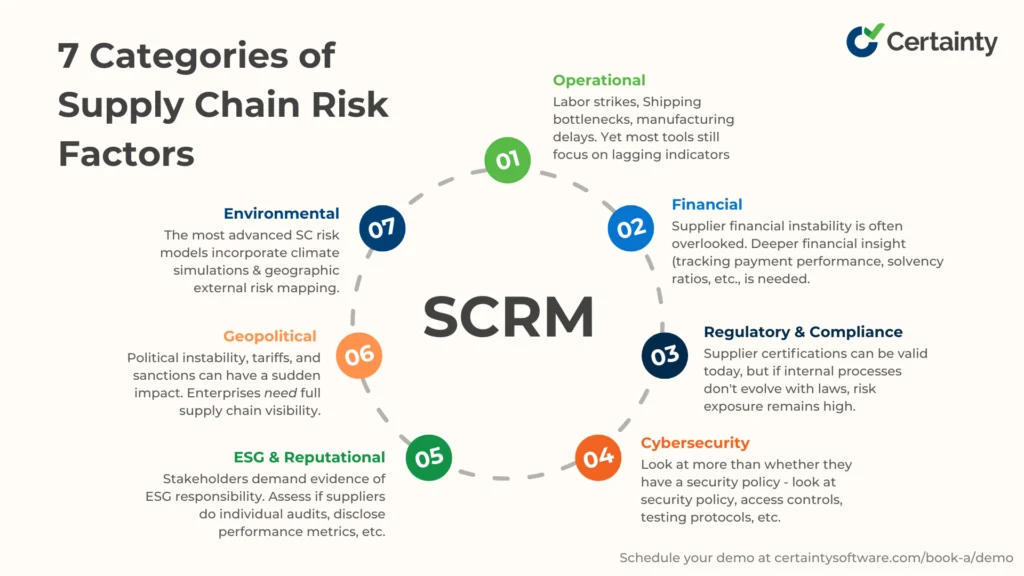

7 Categories of Supply Chain Risk Factors That Matter Most to Compliance Teams

The term “supply chain risk” often conjures images of container ships stuck in ports akin to the cargo ship stuck in the Suez Canal in 2021, or delayed deliveries. However, the true supply chain threat lies in the layered and hidden vulnerabilities that accumulate over time, spanning physical, digital, environmental, and regulatory realms.

Let’s take a closer look at the key risk areas shaping modern SCRM:

Operational Risk

Disruptions like labor strikes, shipping bottlenecks, and manufacturing delays have become more frequent and less predictable. Yet many management tools still focus solely on lagging indicators like missed shipments. The more effective approach involves tracking predictive signals:

- capacity constraints,

- upstream production volatility,

- and supplier lead time drift.

These early warnings provide the lead time needed to reroute or renegotiate before issues become crises.

Financial Risk

Supplier financial instability is often overlooked, especially if orders are being fulfilled. Yet underneath, liquidity issues, mounting debt, or dependency on volatile markets can cause potential disruptions. Regular credit checks help, but deeper financial insight comes from tracking payment performance, solvency ratios, and even external factors like local currency fluctuations in supplier regions.

Regulatory and Compliance Risk

Regulatory environments are constantly in flux. New data privacy laws, evolving labor standards, and product-specific safety regulations shift year to year—and often region by region. A supplier’s current certification might be valid today, but if their internal processes haven’t evolved alongside the laws, risk exposure threats remain high. Monitoring change management maturity is just as important as verifying documentation.

How can you ensure that the compliance data your suppliers provide is trusted? We’ve put together a resource that guides you through the signs of untrustworthy supplier data and how to ensure your suppliers are in alignment with your compliance goals. Learn more here.

Book a demo today to explore Certainty’s audit and inspection management solution

Cybersecurity Risk

Digital transformation has connected global supply chains. In doing so, it has introduced new cyberattack vulnerabilities. Breaches originating in third-party vendors are increasingly common. Evaluating a supplier’s digital posture means looking at more than whether they have a security policy, but also reviewing their penetration testing protocols, access controls, incident response plans, and system redundancy.

ESG and Reputational Risk

Surpassing boardroom discussions, stakeholders demand evidence of environmental and social responsibility throughout the value chain. That includes supplier labor practices, emissions data, and governance standards. Surface-level ESG pledges won’t suffice any longer. Compliance leaders must assess whether suppliers conduct individual audits, disclose performance metrics, and ultimately improve over time.

Explore our ESG Management articles to help strengthen your ESG risk avoidance and mitigation.

Geopolitical Risk

Political instability, tariffs, and sanctions can dismantle a supplier network overnight. Organizations need visibility into where their materials come from, what dependencies exist across tiers, and how upstream supply chain disruptions might ripple into production lines or compliance obligations – evaluating risk at the country level is not enough.

Environmental Risk

Climate-related natural disasters – extreme weather, drought, floods, pandemics, or wildfires- have jumped in both frequency and severity. A supplier located in a floodplain or wildfire-prone region can disrupt months of inventory planning in just one week. The most advanced supply chain risk models now incorporate climate simulations and geographic external risk mapping to help teams preemptively diversify sourcing.

Expert Insight: A recent KPMG report on 2025’s top geopolitical risks highlights supply chain instability and environmental disruption as two of the most urgent threats facing global businesses. These forces are tightly woven into the fabric of supply chain resilience. And yet, they remain under-evaluated in many compliance and procurement programs.

Want to know where you stand compared to other compliance leaders? Then take our Digital Audit and Inspection Management Readiness Quiz.

Scoring and Prioritizing Supplier Risk with Precision

Supply chain failures rarely result from a lack of data. Rather, they come from a failure to connect that data into insight. Supplier risk scoring is one of the most misunderstood tools in a compliance leader’s toolkit. Done well, it becomes a compass for decision-making. Done poorly, it becomes another spreadsheet that gathers dust.

The key is context. Instead of treating suppliers as interchangeable checkboxes, leading organizations build nuanced, living risk profiles that reflect inherent risk and criticality to operations. For example, a supplier with moderate ESG risk may pose a greater threat to continuity if they provide a single-sourced input for a key product line. A high-scoring risk in isolation means little. It’s the downstream implications that matter.

This is where multi-factor models shine. They take into account audit history, operational performance, financial resilience, regional exposure, and even indicators like change in leadership or media-reported incidents. Rather than relying on a one-size-fits-all scoring system, compliance teams are starting to weigh each factor based on what truly moves the needle for their business.

Risk scoring also needs to be actionable. When a vendor’s risk profile changes because of an incident, missed audit, or external disruption, an internal response of the system should be triggered. That might mean escalating to a quarterly audit cycle, issuing a new corrective action, or simply surfacing the supplier for executive review. The most mature programs treat risk scores as a decision-making input woven into procurement, quality, and ESG operations – not as an output.

Access free-to-download supply chain audit checklists

CTPAT Checklist

ESG Checklist

GSCA Due Diligence Checklist

Supplier Corrective Action Form

Supplier Social & Environmental Compliance Checklist

Pro Tip: Consider layering in external data feeds—such as sanctions databases, geopolitical risk monitors, or ESG news aggregators—to keep scores dynamic. A supplier’s risk status shouldn’t only change when you evaluate them. It should evolve as the world does.

How High-Performing Teams Operationalize Risk Intelligence

In most organizations, supplier oversight is fragmented by design. Along the lines of:

- Procurement manages pricing and terms,

- Compliance handles audits and regulatory checks,

- ESG teams track sustainability metrics,

- and operations chase on-time performance.

Each team holds a piece of the puzzle—but rarely the full picture.

Operationalizing supply chain risk management means creating connective tissue between these functions. High-performing teams establish a shared language around risk. They agree on what defines a “high-risk supplier,” how issues are escalated, and what metrics get reported to leadership.

Asset: What is a supplier risk assessment?

Technology plays a big role – there is no doubt about this. But alignment comes first. A dashboard is only as good as the definitions it reflects. When procurement sees a flagged supplier, they must be able to trust that the score was derived from criteria relevant to both operational continuity and compliance standards. When a corrective action is triggered, the team executing it needs to know where the risk originated and what success looks like.

Some of the most effective organizations embed risk checkpoints directly into procurement workflows. Before renewing a contract or onboarding a new vendor, risk scores are reviewed, flagged issues are surfaced, and escalation rules are applied. This due diligence prevents risk from becoming an afterthought—or worse, a post-incident discovery.

Why SCRM Programs Falter Even With Good Intentions

The gap between SCRM policy and SCRM reality usually reveals itself during a crisis. A supplier audit gets missed, a non-compliance issue goes unresolved, or a long-trusted vendor fails to deliver during a surge period.

Often, it points back to the same root causes: scattered data, siloed accountability, and blind spots in the supplier base.

A most common pitfall is mistaking volume for visibility. A company may conduct hundreds of audits annually, but if the findings sit in disconnected reports or PDF files that no one reviews collectively, the program is merely performative. True risk visibility comes from the number of decisions improved from the findings.

Over-reliance is another weak point within trust-based relationships. Longtime suppliers are often given implicit passes, even when early warning signs such as financial strain, shifting leadership, and declining performance start to emerge. Without mechanisms for continuous evaluation, this complacency can snowball into major disruptions.

Visibility itself is often the biggest obstacle. Many companies don’t have a clear line of sight into where their suppliers source materials, how potential risks are evolving across tiers, or which vendors operate outdated compliance controls. Without integrated platforms or consistent reporting frameworks, teams rely on stale assessments and assumptions.

As for ESG metrics, self-reporting can in some cases be another trap. Many organizations are leaning heavily on supplier-declared sustainability metrics without validating them. Mature programs are now building layered evaluations where they combine internal audits, third-party certifications, and observational data to separate signal from noise.

The Untapped Potential of Internal Audit Data

Few data sources offer a more direct window into supplier performance than internal audits. These audits capture what happens on the ground, not just what was promised in a proposal or captured in a policy.

And yet, audit data is often underused. The findings are collected, logged, and maybe filed away in a system. But they are rarely mined for patterns or linked to broader risk profiles. This is a large missed opportunity.

Organizations treating internal audit data as a strategic asset can uncover trends that external benchmarks can’t reveal. Repeated documentation lapses might point to a systemic training issue across regions. High rates of corrective action aging could suggest cultural misalignment or poor change management. These insights are transformative.

When audit data is centralized and analyzed alongside supplier performance metrics, incident reports, and ESG evaluations, it becomes the foundation for a truly predictive risk model. Instead of reacting to the same issues year after year, teams can act early. From here, they can quickly provide retraining, restructure contracts, or diversify suppliers to prevent repeat failures.

Implementation Tip: Start by tagging audit findings with standardized categories. This makes it easier to spot frequency, severity, and location-based trends over time.

Why Supply Chain Risk Management Is a Competitive Advantage

Companies thriving in today’s volatile environment utilize risk intelligence as a competitive weapon. Treating resilience as merely a defensive play will no longer suffice.

When supply chain risk management is embedded into the organization’s DNA, teams can:

- make faster decisions,

- shift sourcing strategies with precision,

- and respond to disruption without compromising customer commitments.

Beyond preserving margins, this agility protects reputation, bolsters investor confidence, and builds long-term trust with regulators and customers alike. In fact, institutional investors are increasingly using operational risk exposure as a proxy for leadership maturity, particularly as part of ESG and governance evaluations.

But perhaps most importantly, mature SCRM builds stronger supplier relationships. When providers know that expectations are consistent, performance is tracked fairly, and collaboration is valued, they are more likely to commit to corrective actions, raise issues proactively, and align with your standards. This creates a culture of partnership, not just oversight.

Industry Leader Quote:

“You must be able to identify the risk before you can do anything about it, so the first step toward resilience is understanding your exposure. I think what we learned—and continue to learn through the ongoing disruption—is that you’ve got to have visibility to what you are trying to manage.” – Shane Azzi, Chief Supply Chain Officer, Kimberly-Clark (Source)

How Certainty Software Supports Resilient, Risk-Ready Supply Chains

Certainty Software helps global enterprises close the gap between risk awareness and risk action. An extension of your supplier risk assessment management ecosystem, we give you the critical infrastructure for smarter oversight, better decisions, and measurable progress.

Whether your team is building a scalable SCRM program from the ground up or modernizing legacy systems, Certainty provides the flexibility and structure needed to succeed across compliance, quality, ESG, and procurement functions.

Our platform empowers teams to:

- Conduct mobile-enabled audits from any location, syncing results instantly to a centralized system

- Use customizable templates aligned with global frameworks like ISO, CTPAT, and internal SOPs

- Segment supplier risk by business unit, location, or category for more targeted oversight

- Issue escalation, corrective actions, and audit scheduling automation for high-risk vendors

- Visualize trends in real time—spotting patterns before they escalate into disruptions

- Connect supplier audit data with ESG metrics, financial insights, and operational KPIs for full-context reporting

The result? Less friction. More foresight. And an approach that scales, mitigating risks as your entire supply chain evolves.